In the 1990s, CRM systems arrived like missionaries of order. And they arrived with the promise of tidy pipelines, searchable contact logs, and measurable action and productivity. They made sense of sales, what had been chaotic, manual, and scattered. And for a while, they worked.

They helped us record everything.

But somewhere along the way, the world outgrew what they offered.

Picture this: It’s 10 PM on a Tuesday. Sarah, your star account manager, is staring at her laptop screen, scrolling through endless CRM records about GlobalTech Industries—her biggest potential deal this quarter. Two years of meetings, demos, and emails. Mountains of data. But the one thing she desperately needs to know remains a mystery: Will they actually buy?

This scene plays out in sales organizations worldwide, every night. The gap between what we track and what we need to know has defined sales technology for thirty years.

Something is changing. And it’s not another integration or dashboard feature.

We’ve been asking our technology the wrong questions.

For three decades, we’ve demanded: “What happened?” Our CRM systems, dutiful as librarians, have responded with immaculate records. Every call logged. Every email tracked. Every deal stage documented.

But the question that keeps sales leaders awake at 3 AM is different entirely: “What happens next?”

The distance between these questions is the distance between a filing cabinet and a crystal ball. Between systems that watch and systems that think.

Part I: The Great Cataloging — When Order Became Obsession

Remember the sales manager of 1995, drowning in Post-it notes and coffee-stained spreadsheets? Then CRM arrived like a digital Marie Kondo, promising to organize the chaos into neat, searchable categories.

“Finally,” we thought, “we can see what’s really happening.”

And it worked. Magnificently.

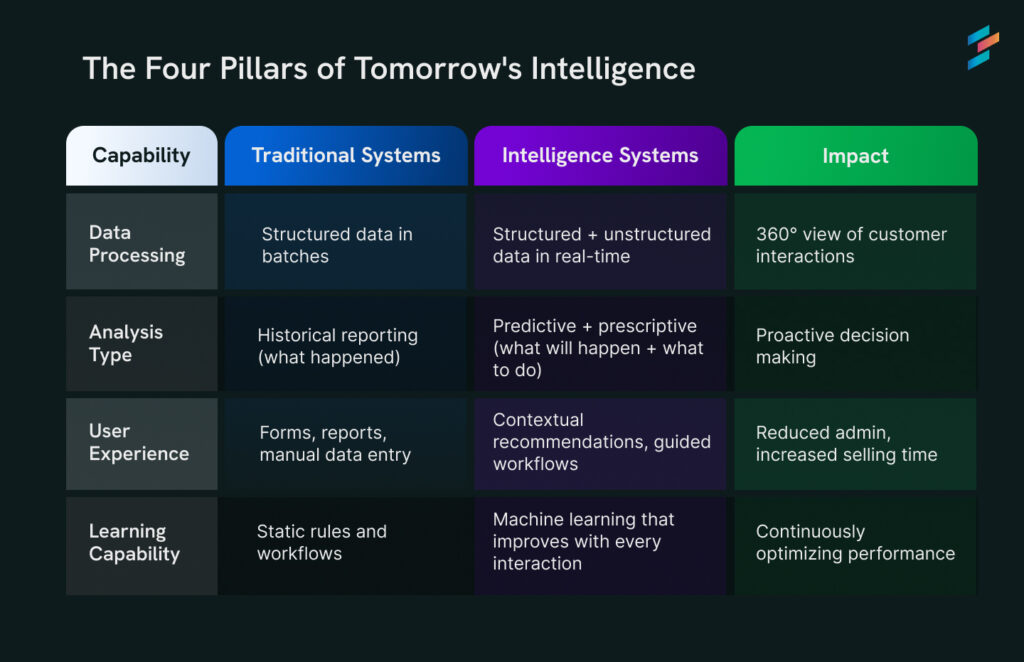

These systems became our digital janitors—cleaning up the mess, organizing the clutter, making everything findable. They excelled at the fundamentals of record-keeping, but here’s what we didn’t anticipate:

Perfect record-keeping and useful intelligence are completely different things.

Your CRM can tell you that Sarah from TechCorp downloaded three whitepapers, attended two webinars, and visited your pricing page fourteen times. Impressive data collection. But it cannot predict the one thing that actually matters: Is Sarah ready to buy?

The Anatomy of Ignorance

Consider this daily reality:

“How’s the GlobalTech deal progressing?”

“Great engagement. Five meetings, three demos, tons of questions.”

“What’s your gut say?”

“That’s the problem. Something feels… off.”

This conversation happens everywhere, every day. The unease that experienced reps feel—the subtle shift in tone, the CFO’s mysterious absence from recent calls, the way technical questions have become more theoretical—none of this appears in any field or report.

The spaces between the data points often contain the most critical intelligence.

Part II: The Four Cracks in the Foundation

Traditional record-keeping systems fail because they cannot bridge four critical gaps:

The Lead Qualification Theater

Your system shows a prospect consuming every piece of content you’ve produced. But are they a buyer or a competitor doing reconnaissance? Your historian cannot distinguish between curiosity and intent.

Lead scoring awards points like a kindergarten teacher handing out gold stars. Job title: 20 points. Company size: 15 points. Downloaded whitepaper: 10 points. As if human buying behavior could be reduced to a simple equation.

The Pipeline Prediction Farce

Deal stages and crossed fingers. Historical averages and sales rep intuition. This is what passes for forecasting in most organizations.

“It’s been in ‘Proposal’ for 47 days. Is that normal?”

“I don’t know. Probably?”

The Account Intelligence Void

An existing customer hasn’t expanded their contract in two years. Your CRM flags this as concerning. But it cannot tell you whether they’re planning a massive expansion, evaluating competitors, or simply dealing with budget constraints from a recent acquisition.

Context remains invisible. Intelligence is reduced to traffic light colors.

The Activity Optimization Blindness

Your rep made fifty calls last week. Congratulations. Were they the right fifty calls? Your system tracks effort, not effectiveness.

We’ve been measuring what’s easy to measure, not what matters.

Part III: The Uprising — When Machines Will Start to Think

The realization hit like lightning: “We needed fortune tellers, not accountants.”

This sparked a quiet revolution. What if technology could do more than record? What if it could reason, predict, and guide?

Enter the emerging systems of intelligence—technology that will connect dots, predict outcomes, and suggest actions.

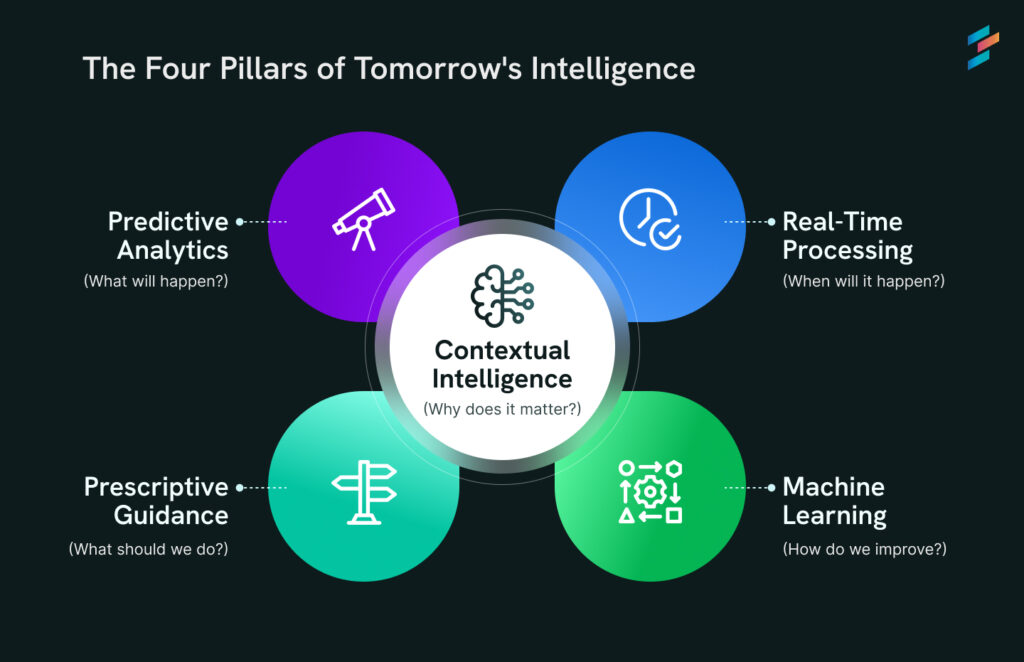

The Four Pillars of Tomorrow’s Intelligence

1. Predictive Analytics: The Art of Seeing Tomorrow

Imagine systems that will analyze 200+ factors simultaneously: email response patterns, meeting attendance, stakeholder engagement depth, competitive mentions, buying committee dynamics. Not to create reports, but to predict closing probability with remarkable accuracy.

Sarah from TechCorp, who downloaded those whitepapers? The system won’t just record her activity—it will recognize the pattern. Companies matching her profile, exhibiting this engagement sequence, with this timing, historically convert 73% of the time within 14 days.

The system will whisper: “Call Sarah Thursday afternoon. She’s ready.”

Think of it like having a weather forecaster who doesn’t just tell you it rained yesterday, but can predict with 85% accuracy whether it will rain next Tuesday—and at what time.

2. Prescriptive Guidance: Your Strategic Advisor That Never Sleeps

Prediction without direction is just fortune-telling. Intelligence systems will go further—becoming your most knowledgeable colleague.

When competitor involvement is detected, the system won’t just flag the threat. It will recommend specific positioning strategies, surface relevant battle cards, identify the optimal stakeholder to address concerns.

Companies like Gong are already building foundations for this future, analyzing conversation patterns to provide coaching recommendations. Since Gong launched their AI-powered engagement platform, companies report outreach response rates increasing “from 16% to 30%” – an 88% boost. The next leap will be real-time strategic guidance that adapts to each unique situation.

3. Real-Time Processing: The End of Yesterday’s News

Traditional systems process data like newspapers—delivering yesterday’s news with today’s date. Intelligence systems will pulse with real-time awareness.

Key stakeholder changes jobs? Immediate alert with context and recommended actions. Competitor mentioned in email? Instant notification with competitive positioning guide.

The gap between event and awareness will collapse.

4. Contextual Intelligence: The Web of Understanding

Perhaps most remarkably, these systems will understand relationships between isolated data points.

Recent company news connects to hiring patterns, which relates to technology investments, which influences buying committee dynamics. The system will weave these threads into insights no human could maintain at scale.

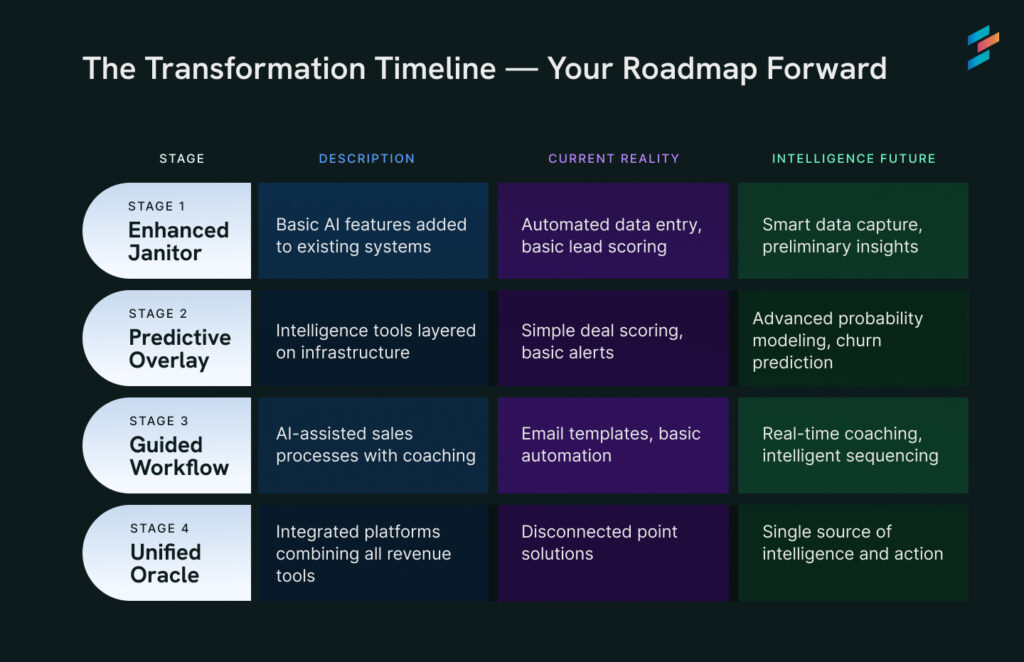

Part IV: The Transformation Timeline — Your Roadmap Forward

Most organizations hover between stages 1 and 2. The destination is clear: fully integrated platforms that will transform how revenue teams think, decide, and act.

Part V: The Evidence — What Early Adopters Are Seeing

While fully intelligent systems are still emerging, early implementations are showing compelling results:

- Response Rate Improvements: Companies using AI-powered engagement tools report outreach response rates increasing from 16% to 30%—an 88% boost, while businesses implementing AI in sales report a 50% increase in leads and appointments

- Forecast Accuracy: 81% of companies using AI in sales forecasting reported improvements in their sales and revenue forecasting accuracy, with many seeing dramatic improvements in prediction reliability

- Revenue Impact: Sales teams using AI are 1.3x more likely to see revenue increases, with 84% of early adopters reporting that AI helped increase sales by enhancing and speeding up customer interactions

Maria Santos, CRO at a fast-growing SaaS company, puts it perfectly: “It’s like having a research team of a thousand people working on every account. Except this team never sleeps, never forgets, and spots patterns we’d miss even if we had all the time in the world.”

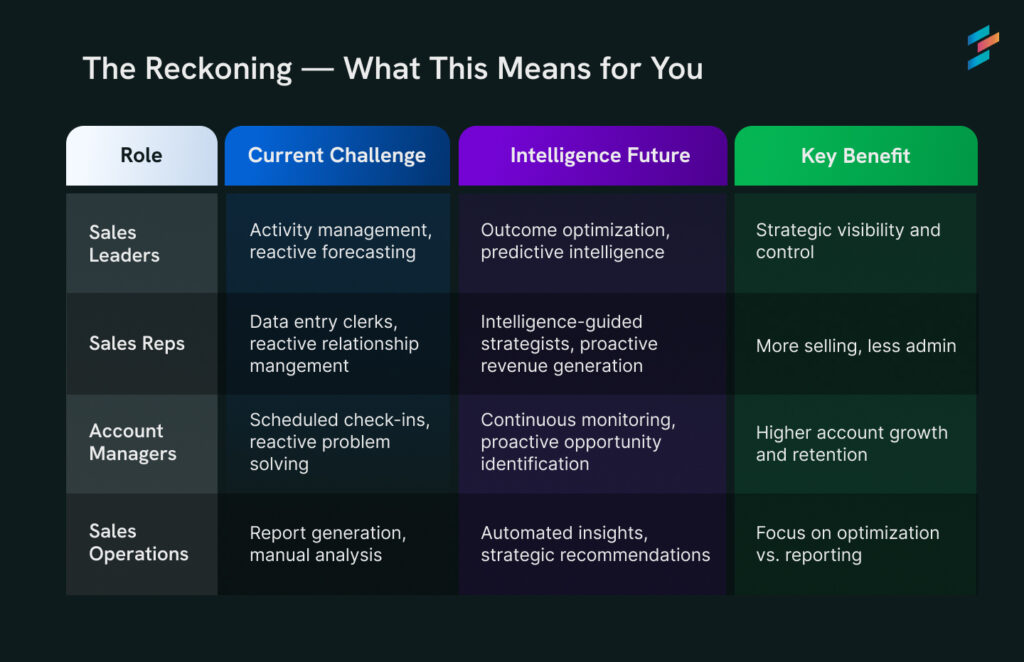

Part VI: The Reckoning — What This Means for You

The Uncomfortable Truth

Every sales leader faces the same choice: Lead this transformation or be swept away by it.

The age of digital janitors is ending. The age of machine oracles is beginning.

Remember Sarah, staring at her laptop at 10 PM, wondering about GlobalTech? In tomorrow’s world, her system won’t just show her what happened in those two years of interactions. It will tell her exactly what to do next—and why it will work.

The question isn’t whether this will happen. It’s whether you’ll be among the first to see around corners—or the last to realize the game has changed.

What future are you building?

Sources and References

- AI Sales Performance Statistics: Salesforce State of Sales Report (2024) – Sales teams using AI are 1.3x more likely to see revenue increases; 84% of current users report AI helped increase sales

- Response Rate Improvements: Gong Engage Platform Results (2023) – “Since we launched Gong Engage, our outreach response rates have increased from 16% to 30%. That’s an 88% boost.”

- Lead Generation Impact: McKinsey Research via Convin (2025) – “Businesses implementing AI in sales report a 50% increase in leads and appointments while cutting costs by 40% to 60%”

- Forecast Accuracy: Accenture Survey (2024) – “81% of companies that used AI in sales forecasting reported an improvement in their sales and revenue forecasting accuracy”

- Market Growth: World Economic Forum (2024) – “By 2024, the global market for conversational AI is estimated to reach $22.6 billion”

- Competitive Landscape: Gong Sales Insights (2024) – “Since 2022, the average number of competitive mentions increased by 57%”