Research analyzing more than 2.5 million recorded sales conversations found that anywhere between 40% and 60% of deals end up lost to customers who express their intent to purchase, but ultimately fail to act.

The average B2B buying group has grown from 5.4 stakeholders in 2014 to potentially 10.2 by 2018, yet the standard org chart for Microsoft Dynamics functionality only shows reporting relationships, not actual influence patterns. In this blog we will discover the best Relationship Mapping Apps for Microsoft Dynamics CRM.

The $2.3M Problem: When Relationship Blindness Kills Deals

Here’s what happens in lost deals:

When purchase likelihood is measured against buying group size, a single decision-maker gives you 81% odds of purchase. Add a second person and the likelihood drops to 55%. Once you reach five or more people, the likelihood of reaching a decision falls dramatically.

The problem is that relationship mapping for Microsoft Dynamics remains stuck in contact list management while enterprise decision-making has evolved into complex influence networks.

Meanwhile, most Dynamics 365 add-ons promise relationship intelligence but deliver glorified contact managers that overlook the hidden power dynamics that determine whether your deal lives or dies.

The relationship mapping problem breaks down into four deadly blind spots:

- Hierarchy Illusion: A typical buying group for a complex B2B solution involves six to ten decision makers, but org charts only show reporting structures. The assistant who schedules executive calendars often has more deal influence than the VP who loves your solution.

- Champion Misidentification: Sales teams consistently mistake enthusiastic users for influential champions. Enthusiasm doesn’t equal political capital or decision-making authority.

- Decision Process Blindness: On average, 13 people are involved in B2B purchase decisions, including end-users, financial approvers, and other influencers. Miss any critical stakeholder, and they can torpedo your deal from the shadows.

- Influence Network Ignorance: Relationships connect in webs, not hierarchies. The procurement manager who seems neutral might be the CFO’s trusted advisor from their previous company.

Why Your Current Dynamics Setup Makes Things Worse

Standard Dynamics relationship management creates a dangerous illusion of understanding. You see contact records, activity logs, and org charts. You feel informed. You’re actually flying blind.

The Contact Activity Trap

HubSpot research shows the average B2B sales win rate is just 21%. Your Dynamics tracks who attended meetings and opened emails, but it doesn’t reveal:

- Who stakeholders trust for advice after your meetings

- Which relationships drive technical vs. business vs. financial decisions

- How informal influence flows through organizational networks

- Who has veto power over purchasing decisions

The Engagement Mirage

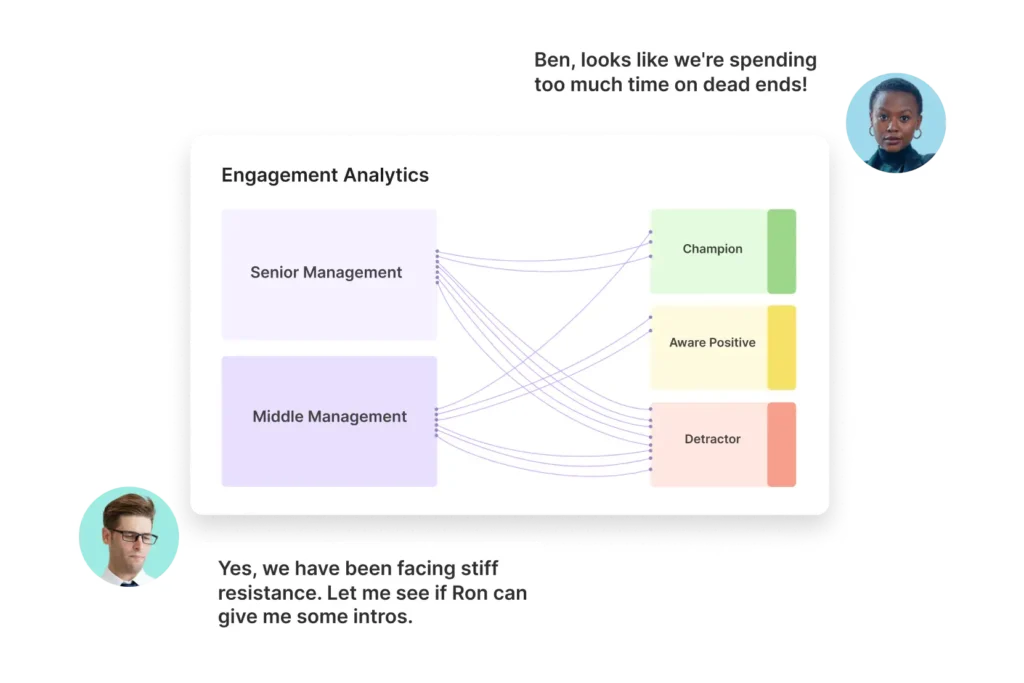

High activity doesn’t equal high influence. The stakeholder responding to every email might be eager but powerless. Meanwhile, the executive who never responds might be your biggest champion, but they’re just delegating evaluation to trusted lieutenants.

The Org Chart Deception

Dynamics org charts show formal reporting relationships, but in 79% of purchases, the CFO holds final decision-making power regardless of who initially drove the evaluation. Understanding these real power dynamics requires intelligence that standard CRM systems can’t capture.

3 Best Relationship Mapping Apps for Microsoft Dynamics

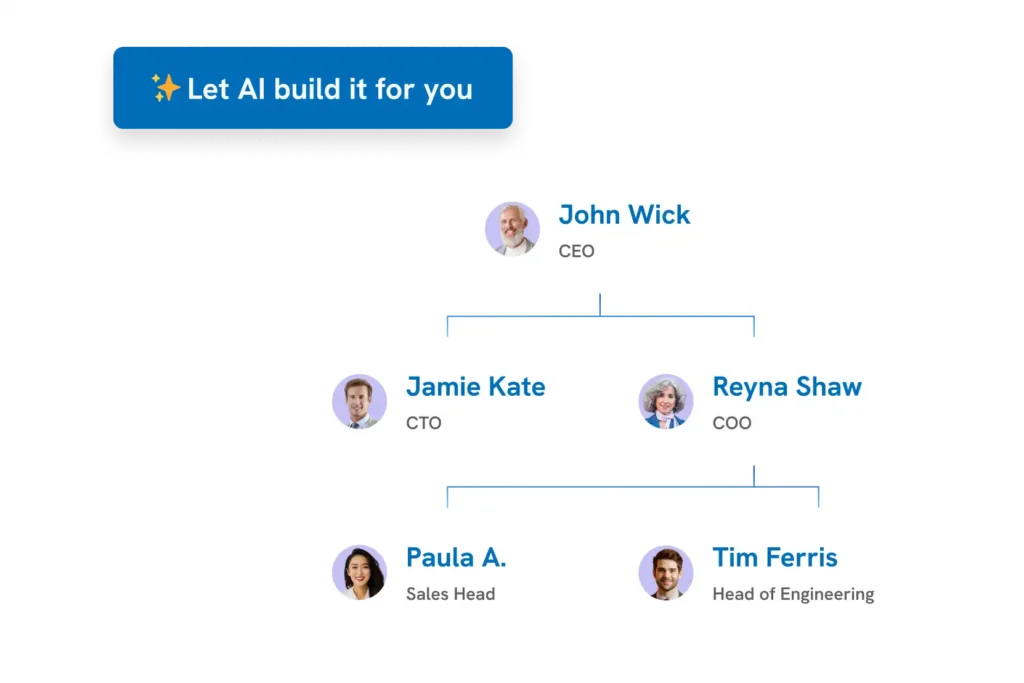

1. DemandFarm: Relationship Mapping For Microsoft Dynamics CRM

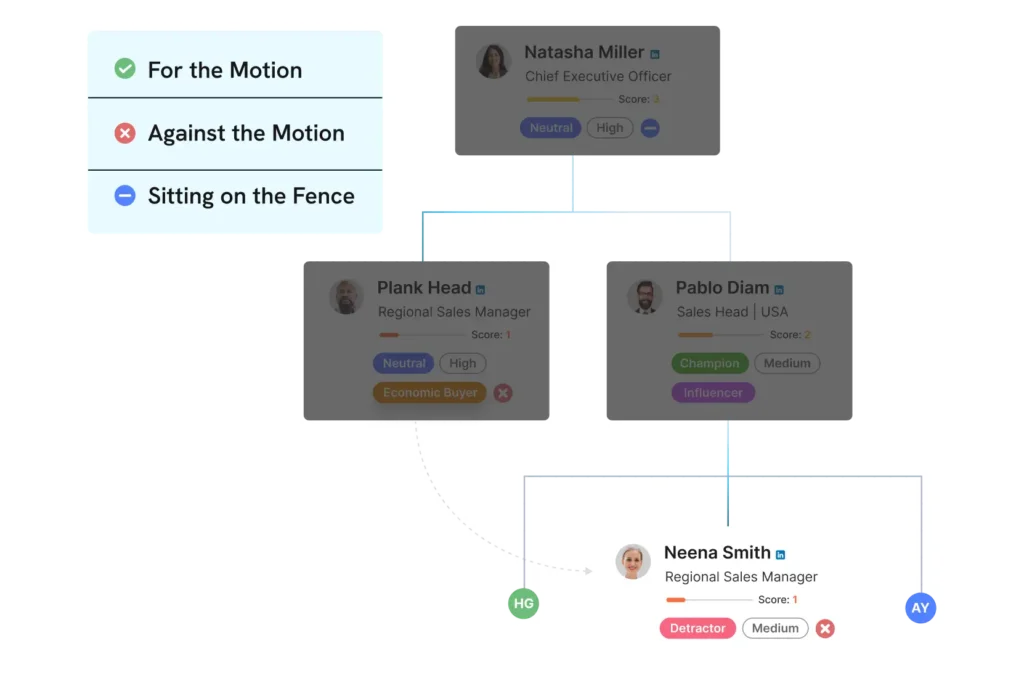

DemandFarm Org Chart for Relationship Mapping is built around a core insight: relationships drive enterprise decisions, not hierarchies. While competitors digitize contact management, DemandFarm visualizes power, affinity, and influence networks in business relationships.

What Makes It Different:

Auto Created Org Charts: Automates org chart creation using AI, saving account managers valuable time by eliminating manual mapping and constant updates.

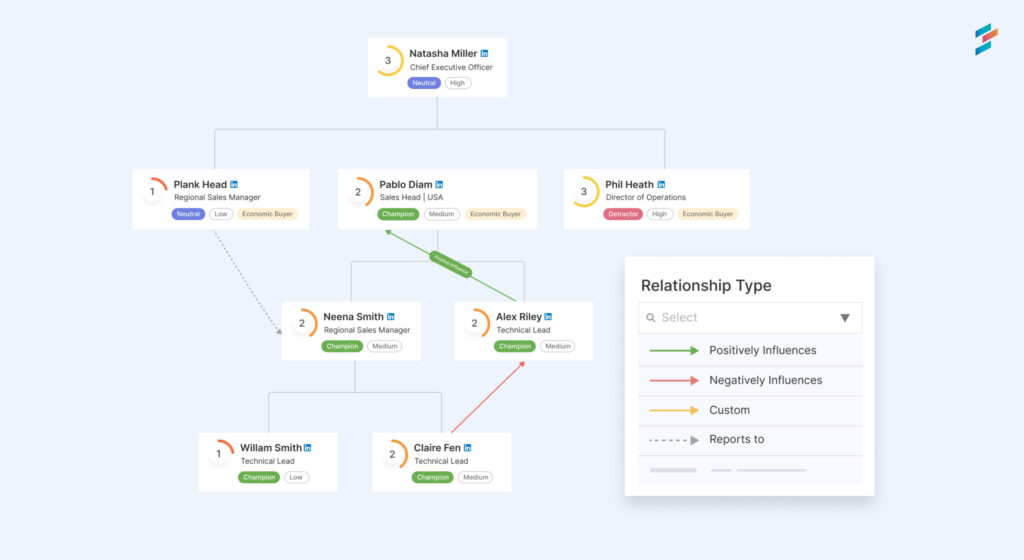

Deep & Interactive Influence Maps: Click any stakeholder and see their relationship web like who they influence, who influences them, and how information flows through networks. Not just reporting relationships, but actual influence patterns based on behavioral analysis.

AI-Powered Champion Identification: DemandFarm analyzes email patterns, meeting behavior, and proposal engagement to distinguish real champions from enthusiastic evaluators. It identifies stakeholders who forward information internally, include colleagues in conversations, and advocate for solutions in internal discussions.

Relationship Engagement Health: Visualizes your team’s interactions with key account stakeholders, providing actionable analytics on communication frequency, quality, and overall engagement. This empowers sales leaders and account managers to continuously monitor relationship health, identify unseen gaps or risks, and act proactively to strengthen trust and secure strategic accounts.

Whitespace Integration: Combines relationship intelligence with opportunity analysis, showing which products/services each stakeholder could authorize and mapping relationship paths to reach economic buyers for different offerings.

2. Map My Relationships

Map My Relationships by Inogic is a visualization tool for Microsoft Dynamics 365 CRM that helps display and explore connections between records in an interactive format.

-

Visualizes connections between records in Microsoft Dynamics 365 CRM using mind map and hierarchy views.

-

Supports 1:N, N:1, and N:N relationships across both standard and custom entities.

-

Enables multi-level drill-down into relationships and displays aggregate values without manual rollup fields.

-

Allows in-map actions such as logging calls, sending emails, and creating new records.

-

Offers customization options like color-coding, labels, and images to differentiate roles and relationship types.

3. Powerscope

Powerscope by Perfluence is a tool designed for relationship capital management and influence network visualization. It supports business developers, key account managers, and strategic dealmakers in mapping, analyzing, and managing complex organizational and stakeholder relationships.

-

Visualizes influence networks and decision-making stakeholders, showing relationships, business drivers, preferences, and reporting lines in an interactive graph.

-

Generates relationship matrices that display who knows whom within teams and clients, including relationship intensity.

-

Automatically creates organizational charts to illustrate power dynamics and influence structures in target organizations.

-

Manages key contacts with detailed relationship types (e.g., interpersonal, hierarchical, functional) and relevant information such as biographies and business drivers.

-

Provides an engagement plan feature to organize teamwork and improve insights on opportunities or deals.

-

Designed to complement CRM systems by enhancing the management and value of relationship capital.

This tool targets professionals managing influence and relationships in complex B2B environments, aiming to support strategic decision-making and relationship mapping.

How to Implement Relationship Intelligence (Without the Theatrics)

Most relationship mapping implementations fail because they focus on software deployment instead of intelligence development. Here’s what works:

Phase 1: Relationship Reality Check (Week 1)

Before implementing technology, understand your current blind spots:

Influence Gap Analysis:

- For top 10 active opportunities, identify every stakeholder who could influence decisions

- Flag relationships between stakeholders you’re assuming vs. actually knowing

- Document informal influence patterns you’ve observed but aren’t tracking

Decision Process Audit:

- Map official purchasing processes for each opportunity type

- Identify where deals typically stall or die unexpectedly

- Organizations using external advisors see longer cycles (13.6 vs 6.5 months) and larger buying groups (12.9 vs 6.4 people), track consultant involvement

Phase 2: Strategic Tool Selection (Week 2)

Choose based on intelligence needs, not feature checklists:

For Complex Enterprise Deals (6+ stakeholders, 6+ month cycles): DemandFarm provides visual intelligence and behavioral analysis needed to navigate political complexity effectively.

For Simple Transactional Sales (1-3 stakeholders, predictable processes): Microsoft’s native capabilities might suffice for basic relationship awareness.

For Methodology-Driven Organizations: Prolifiq works if framework compliance matters more than relationship intelligence depth.

Phase 3: Intelligence Integration (Weeks 3-4)

Connect relationship intelligence to actual selling activities:

Pre-Call Planning: Use relationship maps to identify meeting participants and navigate stakeholder dynamics strategically.

Post-Call Intelligence: Update influence maps based on new stakeholder relationship information and political insights gathered.

Deal Strategy Development: Leverage relationship intelligence for multi-threading approaches and identifying missing influence connections.

Phase 4: Results Measurement (Month 2+)

Track intelligence effectiveness, not platform usage metrics:

Leading Indicators:

- Economic buyer identification speed (target: within 30 days)

- Stakeholder relationship mapping completeness per opportunity

- Multi-threading success rate beyond primary contacts

Lagging Indicators:

- Win rate improvement on complex deals (3-6 months to measure)

- Sales cycle reduction through better stakeholder engagement

- Forecast accuracy enhancement via relationship health insights

What Actually Works: Relationship Intelligence vs. Contact Management

The organizations winning complex deals don’t have better products. They just have better intelligence about how decisions really happen.

Visual Influence Mapping: Instead of contact lists, they see relationship webs showing who influences whom, who trusts whom, and who has actual veto power over decisions.

Stakeholder Behavioral Analysis: They track engagement patterns revealing real influence. The executive who forwards your proposal internally without comment shows champion behavior. The manager asking detailed questions but never including colleagues is likely an evaluator, not a decision-maker.

Political Landscape Intelligence: They understand organizational dynamics that drive decisions, budget battles, departmental rivalries, and personal relationships that traditional CRM can’t capture.

Multi-Threading Strategy: 72% of buying teams now hire consultants or analysts to help with purchasing decisions. They systematically build relationships across influence networks instead of hoping their primary contact will sell for them internally.

Systematic Intelligence vs. Continued Guesswork – Pick Your Choice

69% of the B2B buying process occurs before business decision-makers will contact a sales team. Your competition is the organizational inertia treating relationship management as contact list maintenance instead of strategic intelligence development.

Organizations winning complex deals have moved beyond hoping primary contacts will sell internally for them. They systematically map influence networks, identify real champions, and navigate political dynamics invisible to traditional CRM analysis.

DemandFarm represents an evolution from relationship tracking to relationship intelligence. While competitors digitize contact management, DemandFarm visualizes influence networks and predicts stakeholder behavior patterns.

Ready to replace relationship guesswork with systematic intelligence? Discover how DemandFarm’s Org Chart transforms complex stakeholder networks into predictable deal outcomes. Book a